HomeNet Kenya membership identified a savings and a loan scheme as an opportunity under the livelihoods improvement thematic area. The process towards realization of the same has been condensed under the need for a Savings and Credit Cooperative Organisation (SACCO) that will enable the membership to set aside money from the crafts and other income streams to build a common fund where they can borrow from to expand their livelihood activities. In the previous year discussions around the bylaws and leadership structure were discussed, draft bylaws were created and an interim committee of seven individuals drawn from across the cluster areas was identified.

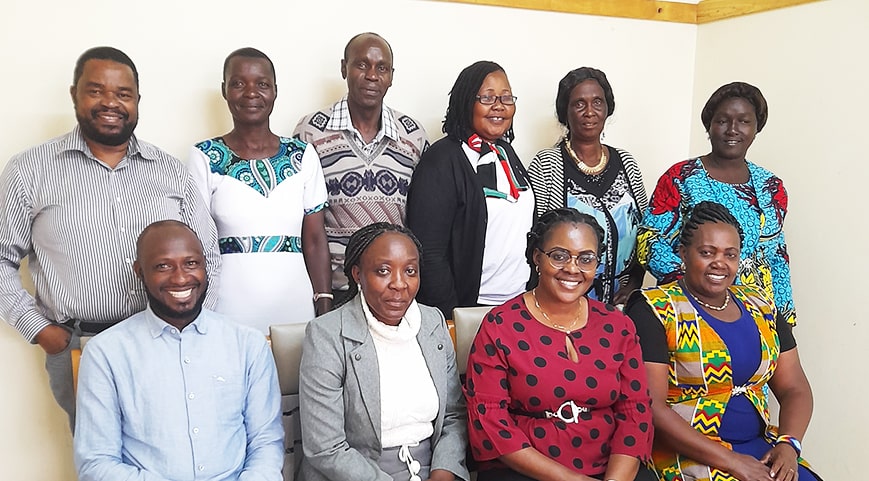

SACCO’s are regulated by the government and the first step towards its registration is a pre-training workshop with the government trainers to enable those intending to set up a SACCO to understand the legal framework and management practices required, including ascertaining its viability. The training was held on the 17th August, 2023 and brought together the seven interim committee members, one national executive committee member and the two trainers from the government.

The workshop focused on the following areas;

- The objectives of the SACCO

- The membership and management structure

- The financial proposals; registration, shareholding and contributions

- Oversight by the membership

- Bookkeeping services

- Registration process and the first general meeting